I’m having a dilemma about trading option spreads. Is it better to execute a multi-leg option spread or should one just trade single options? Option spreads involve simultaneously buying and selling a combination of option contracts within the same transaction.

I’m having a dilemma about trading option spreads. Is it better to execute a multi-leg option spread or should one just trade single options? Option spreads involve simultaneously buying and selling a combination of option contracts within the same transaction.

How these option contracts are combined is referred to as an option strategy. There are many different types of option strategies. This article examines the pros and cons of using a vertical spread option strategy. To understand more about option strategies visit the Option Industry Council education website.

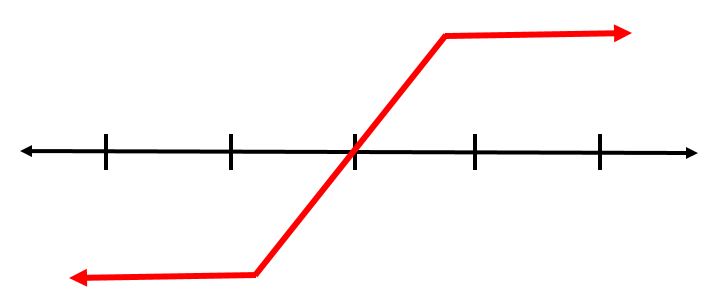

A vertical spread is a two legged option position. It can involve using call options or put options. A vertical spread can be originated as a bull spread or a bear spread. In a vertical spread you buy one option (for a debit) and sell another (for a credit). Both legs of a vertical spread involve the same underlying stock and expire on the same date.

The option you are long or the one you buy, is at or in the money. The option you are short or the one you sell, will be out of the money some amount. The dollar amount between the long and short options is known as the width of the spread. The distance between the two option prices affects the total cost of the vertical spread. The width of the spread in this example will equal $5.

The symbol for the stock is ABC. Current market price of ABC is $50 per share. Both options in the vertical spread expire in 30 days.  The long option has a strike price of $50 and a cost of $3.50. The short option has a strike price of $55 and sells for $1.25. The total cost of 1 vertical (bull) call spread in this example equals $225.

The long option has a strike price of $50 and a cost of $3.50. The short option has a strike price of $55 and sells for $1.25. The total cost of 1 vertical (bull) call spread in this example equals $225.

The cost of the call we buy is $3.50 per share. One option contract controls 100 shares of stock so, $3.50×100 = $350. The call we sell gains us $1.25 per share. Since one contract controls 100 shares of the underlying stock, the money we are paid for selling the call option is $125.

The total cost for one bull call vertical spread is $225. ($350 – $125 = $225) If we want to control 1,000 shares of the underlying stock then we will need to execute 10 spreads. The cost for 10 spreads, using our example, in total is $2,225. Let’s talk pros and cons of executing an option spread compared to just trading a single option contract.

One benefit is a reduced overall option position cost. Selling one side of the option spread reduces overall  position cost. In the above example, selling a call for a $1.25 reduced the position cost by $125. By selling the call overall position cost was reduced, however, overall profit was also limited to the width between the long and short option positions.

position cost. In the above example, selling a call for a $1.25 reduced the position cost by $125. By selling the call overall position cost was reduced, however, overall profit was also limited to the width between the long and short option positions.

Another benefit from the short side of the spread is downward price movement protection. This assumes market conditions reduce the value on both sides of the spread proportionally. If so, we could then buy back the short side of the spread for less money than we originally sold it for.

For example, the call option we originally sold for $1.25 is now priced at $0.75. What we sold for $125 now costs $75 to buy back. This call price movement affords us a potential gain of $50, if we choose to close out that side of the spread. Closing the short side of our option spread leaves us with only a single option open.

The drawback is if the underlying stock moves in a positive direction, the short call in the spread, loses value. If ABC increased $5 then the long call would also increase in value but the short call would decrease in value, decreasing the overall profitability of the vertical spread trade. Closing out of a vertical spread position is a slightly a more difficult order to enter and execute.

![]() ONCLUSION: Trading a vertical spread vs. trading a single option contract has been beneficial for me the majority of the time. Training a vertical spread also reduces the cost of the position when using options in a stock replacement trading strategy.

ONCLUSION: Trading a vertical spread vs. trading a single option contract has been beneficial for me the majority of the time. Training a vertical spread also reduces the cost of the position when using options in a stock replacement trading strategy.

Reality is that less than 50% of my option trades are executed as spreads. However, 80% of the time buying back the short call of a vertical spread has helped the profitability of executing an option trade. Do as I say, not as I do.