Is it better to buy or sell put options? What kind of transactions involve put options? How can I profit from trading puts? What are the mechanics of a put spread?

Is it better to buy or sell put options? What kind of transactions involve put options? How can I profit from trading puts? What are the mechanics of a put spread?

A put is an option contract that gives its owner an ability to sell shares of stock at a predetermined [strike] price by a specific [option expiration] date. To understand how options work in general and put options specifically, visit the Option Industry Council web site.

A put option gives its owner the right to sell stock, at a specific price, by a future date. Buying put options become profitable when the underlying stock drops in price. Buying a put option is one way to benefit from the decreasing stock price without selling short the stock. Buying a put option is also a way to protect your stock position from a decline in price.

An option buyer has no obligation, only the right, to sell stock. Once the option expires that right also expires. One option contract controls 100 shares of underlying stock. Exercising a put option gives its owner the ability to sell stock for a specific price. No matter how low the price of the underlying stock drops your loss is limited to the option strike price. Buying a put option is one way to protect a stock position by limiting potential losses.

You buy a put option if you think the price of a stock is going to go down.  You’re betting that the price of the stock goes down. How does it work? Going long or buying a put option gives you the right to sell stock for a specific price. If you can sell at a higher price and by at a lower price you can make a profit..

You’re betting that the price of the stock goes down. How does it work? Going long or buying a put option gives you the right to sell stock for a specific price. If you can sell at a higher price and by at a lower price you can make a profit..

If you sell a stock for $50 by buying a put [option] for $2, and later buy the same stock for $40, you realized a profit of $8.The formula below describes exactly that.

($50 – $2) – $40 = $8

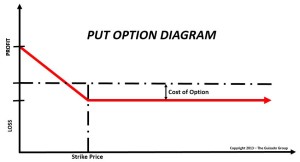

The diagram to the left illustrates a put option from a profit and loss perspective.

Using a [put] spread is where you buy one option and sell another. The cost of the option you buy is offset by the premium you receive for the option you sell. Using spreads reduces the overall cost for an option trade but also limits the overall profit which can be made. Using a spread also limits the profit that can be made. You can buy options but you can also sell options.

By selling a put option you promise to pay a specific price at a future date for a stock. Again, each put contract sold obligates the seller to purchase 100 shares of underlying stock. It doesn’t matter what the stock price declines to, if you sell a put option, you are then obligated to buy the stock at option strike [price].

When you sell an option (call option or put option) you are paid [premium] for giving someone that option. Option premium varies based on the implied volatility of the underlying stock, the strike price of the option and the amount of time until the expiration of the option.

An option reduces in value faster during the last 60 days before expiration. A measure of the rate of decline in the value of an option due to the passage of time is known as the Greek letter theta. Theta can also be referred to as the time decay on the value of an option. If everything else is held constant, an option will lose value as time moves closer to the expiration .

.

You will also pay more premium for an option closer to being in or at the money than you will for one which is further out of the money. The combination of time until expiration (theta), the implied volatility [of the underlying stock] and the strike price of the option combine to specify the premium charged for an option.

Selling a put option generates income much like selling a [covered] call option. When you sell an option your brokerage account is credited [the premium]. When you buy an option your account is debited.

For a covered call the call option you sell is secured by a stock you hold. Selling a put option is secured by your ability to pay [cash in your account or your credit]. Unsecured put options can be covered on margin which is credit available from the financial company that you have a brokerage account with. Selling options can be a good way to generate income. Selling a put option is one way to get long [buy] a stock at a reduced price.

Ultimately the purpose of trading is to make money. The irony of trading is that if you focus on money, you may never make any. That’s because when you encounter an unexpected loss (they’re all unexpected) you’ll start to think about how much money you’re losing to the market. Then you will hesitate just long enough to totally blow up your account.

You should never get into a situation where you risk ruin by letting one trade take 50% of your account. I’ve had more than one trade come back from a big loss over time. I’ve had more than one that hasn’t. It is painful to see that option contract expire worthless. Do as I say, not as I do.

O NCLUSION: I’ve come to believe you should never lose more than 50% on a single trade. I think it prudent if you cut your losses at 40%. Taking any loss is painful. If you think in percentage terms, every trade is just a basis point win or loss. It’s never personal, it’s just business. Exactly how it should be if you want to succeed.

NCLUSION: I’ve come to believe you should never lose more than 50% on a single trade. I think it prudent if you cut your losses at 40%. Taking any loss is painful. If you think in percentage terms, every trade is just a basis point win or loss. It’s never personal, it’s just business. Exactly how it should be if you want to succeed.

Over 60% of my profits from trading come from selling puts. Buying puts, betting against the market, has cost me almost 15% of my profits. If you sell a put for a low price, the worst thing that can happen is you end up owning a stock on the cheap. Otherwise, you keep the premium. I like that.